# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# World Bank Data using WDI Package

# path: ~/ownCloud/

# file_name:

# files_used:

# files_created

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

#

rm(list = ls(all = TRUE))

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# packages

#install.packages("httr")

#install.packages("XML")

#install.packages('WDI')

#install.packages("magrittr")

#install.packages("tidyverse")

#install.packages("quantmod")

#install.packages("PerformanceAnalytics")

#install.packages("tidyquant")

library("httr")

library("XML")

library("magrittr")

library("tidyverse")

library("WDI")

library("quantmod")

library("PerformanceAnalytics")

#library("tidyquant")

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

#

system("ls")

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# using quantmod to collect data

# selecting the date while downloading

MCD <- quantmod::getSymbols("MCD",src = "yahoo",

auto.assign=FALSE,

from = "2007-06-01",

to = "2012-07-01" )

head(MCD)

tail(MCD)

# or download the available data and selecting later

MCD <- quantmod::getSymbols("MCD",src = "yahoo",

auto.assign=FALSE )

head(MCD)

tail(MCD)

MCD <- MCD["2007-06-01/2012-07-01"]

head(MCD)

tail(MCD)

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# download monthly data

MCD <- quantmod::getSymbols("MCD",src = "yahoo",

auto.assign=FALSE,

from = "2007-06-01",

to = "2012-07-01",

periodicity = "monthly" )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# alternative ways

#stock_list <- c( "IBM", "MCD" )

#

#stocks_weekly <- tq_get(stock_list,

# from = start_date,

# to = end_date,

# periodicity = "weekly")

#stocks_weekly

#install.packages("BatchGetSymbols")

#library(BatchGetSymbols)

#stocks <- BatchGetSymbols( c( "IBM", "MCD" ),

# first.date = "2007-06-01",

# last.date = "2012-07-01",

# freq.data = "monthly",

# how.to.aggregate = 'first')

#stocks

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# for now lets use the example time series

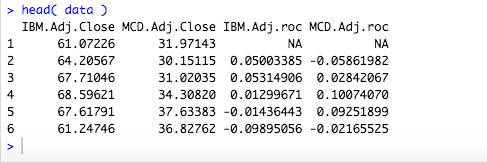

IBM <- read.csv("IBM.csv")

MCD <- read.csv("MCD.csv")

head(IBM)

IBM$Adj.Close

MCD$Adj.Close

data <- data.frame(IBM$Adj.Close,MCD$Adj.Close)

data[,3] <- NA

data[,4] <- NA

data

log( IBM$Adj.Close[2] / IBM$Adj.Close[1] )

# log computes logarithms, by default natural logarithms,

# log10 computes common (i.e., base 10) logarithms, and

# log2 computes binary (i.e., base 2) logarithms.

for(i in 2: length(data[,1]) ){

data[i,3] <- ( log( data[i,1] / data[i-1,1] ) )

}

data

for(i in 2: length(data[,2]) ){

data[i,4] <- ( log( data[i,2] / data[i-1,2] ) )

}

data

colnames(data)[3] <- "IBM.Adj.roc"

colnames(data)[4] <- "MCD.Adj.roc"

head( data )

#in comparison: the ROC function from the quantmod package

# computes the standard deviation of the values in x. If na.rm is TRUE

# then missing values are removed before computation proceeds.

ROC( data$IBM.Adj.Close )

str( as.numeric( data$IBM.Adj.roc[2] ) )

str( as.numeric( ROC( data$IBM.Adj.Close )[2] ) )

as.numeric( ROC( data$IBM.Adj.Close ) ) == as.numeric( data$IBM.Adj.roc )

as.numeric( ROC( data$IBM.Adj.Close )[2] ) == as.numeric( data$IBM.Adj.roc[2] )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# why are they not exactly the same? Starting with the 16th digit the

# numbers differ.

# the continuous formulation of ROC is : roc <- diff(log(x), n, na.pad = na.pad)

# this gives the small difference compared to what we calculated first

# log( t / (t-1) )

# lets try the same

diff( log( data$IBM.Adj.Close ) )

ROC( data$IBM.Adj.Close )[2:length(data$IBM.Adj.Close)] ==

diff( log( data$IBM.Adj.Close ) )

# now it is exactly the same, but for practical reasons such

# minuscule differences do not really matter.

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# if we use the first 5 digits the numbers are exactly the same

print( ROC( data$IBM.Adj.Close )[2], digits = 20 )

print( as.numeric( data$IBM.Adj.roc )[2], digits = 20 )

round( as.numeric( data$IBM.Adj.roc ), 5)

round( as.numeric( ROC( data$IBM.Adj.Close ) ), 5 )

round( as.numeric( data$IBM.Adj.roc ), 5) ==

round( as.numeric( ROC( data$IBM.Adj.Close ) ), 5 )

#options( digits = 10 ) # Modify global options

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# the data preparation phase is somewhat more intensive if using

# a programming tool like R but in the long run i think

# i pays off by having more accessible data that can be processed in a

# much faster way especially if it comes to big data applications

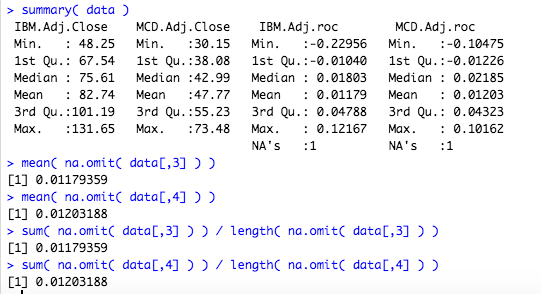

summary( data )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# calculating the mean with a function and out of the data

mean( na.omit( data[,3] ) )

mean( na.omit( data[,4] ) )

sum( na.omit( data[,3] ) ) / length( na.omit( data[,3] ) )

sum( na.omit( data[,4] ) ) / length( na.omit( data[,4] ) )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex formulas

# Mean = \frac{1}{N} \sum_{i=1}^{N} r_i # population and sample mean

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

#

var( na.omit( data[,3] ) )

data[,3] - mean( na.omit( data[,3] ) ) # demeaning

( data[,3] - mean( na.omit( data[,3] ) ) )^2 # power of 2

sum( na.omit( ( data[,3] - mean( na.omit( data[,3] ) ) )^2 ) ) # sum with drop NA

sum( na.omit( ( data[,3] - mean( na.omit( data[,3] ) ) )^2 ) ) /

( length( na.omit( data[,3] ) ) - 1 )

# NA is also omitted for length and we use the sample variance

# therefore we divide by (n-1)

var( na.omit( data[,4] ) )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex formulas

# Var.p = \frac{1}{N} \sum_{i=1}^{N} (r_i-\bar{r})^2

# Var.s = \frac{1}{N-1} \sum_{i=1}^{N} (r_i-\bar{r})^2

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

#

# stats:: calls the package directly

# this is not really necessary unless there are functions with the

# same name in different packages. Then one might be masked be the other

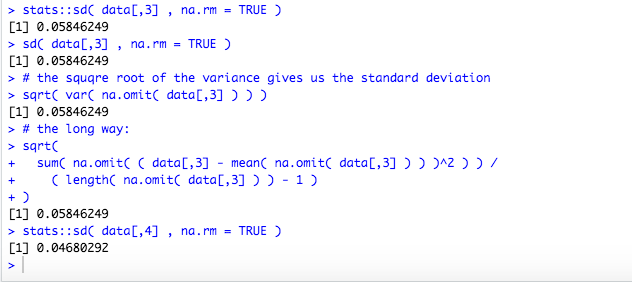

# SD IBM

stats::sd( data[,3] , na.rm = TRUE )

sd( data[,3] , na.rm = TRUE )

# the squqre root of the variance gives us the standard deviation

sqrt( var( na.omit( data[,3] ) ) )

# the long way:

sqrt(

sum( na.omit( ( data[,3] - mean( na.omit( data[,3] ) ) )^2 ) ) /

( length( na.omit( data[,3] ) ) - 1 )

)

# SD MCD

stats::sd( data[,4] , na.rm = TRUE )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex formulas standard deviation

#Stdev.p = \sqrt{ \frac{1}{N} \sum_{i=1}^{N} (r_i-\bar{r})^2 }

#Stdev.s = \sqrt{ \frac{1}{N-1} \sum_{i=1}^{N} (r_i-\bar{r})^2 }

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

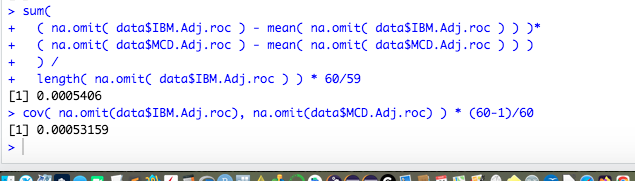

# calculate covariance

cov( na.omit(data$IBM.Adj.roc), na.omit(data$MCD.Adj.roc) )

# this gives the sample covariance

# calculation by hand

na.omit( data$IBM.Adj.roc ) - mean( na.omit( data$IBM.Adj.roc ) )

na.omit( data$MCD.Adj.roc ) - mean( na.omit( data$MCD.Adj.roc ) )

( na.omit( data$IBM.Adj.roc ) - mean( na.omit( data$IBM.Adj.roc ) ) )*

( na.omit( data$MCD.Adj.roc ) - mean( na.omit( data$MCD.Adj.roc ) ) )

sum(

( na.omit( data$IBM.Adj.roc ) - mean( na.omit( data$IBM.Adj.roc ) ) )*

( na.omit( data$MCD.Adj.roc ) - mean( na.omit( data$MCD.Adj.roc ) ) )

) /

length( na.omit( data$IBM.Adj.roc ) ) * 60/59

# length( na.omit( data$IBM.Adj.roc ) ) == 60

# Population covariance

# * (n-1)/n

cov( na.omit(data$IBM.Adj.roc), na.omit(data$MCD.Adj.roc) ) * (60-1)/60

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex formulas Covariances

# Covariance.p = \frac{1}{N} \sum_{t=1}^{N} (r_{it}-\bar{r}_i)(r_{jt}-\bar{r}_j)

# Covariance.s = \frac{1}{N-1} \sum_{t=1}^{N} (r_{it}-\bar{r}_i)(r_{jt}-\bar{r}_j)

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

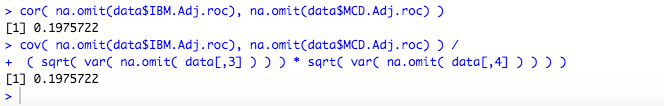

# calculating correlation - sample correlation

cor( na.omit(data$IBM.Adj.roc), na.omit(data$MCD.Adj.roc) )

cov( na.omit(data$IBM.Adj.roc), na.omit(data$MCD.Adj.roc) ) /

( sqrt( var( na.omit( data[,3] ) ) ) * sqrt( var( na.omit( data[,4] ) ) ) )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex formulas Correlation

# Correl(i,j) = \frac{Covar.p(i,j)}{Stdev.p(i)*Stdev.p(j)}

# the full formula

# Correl(i,j) = \frac{Covariance.p = \frac{1}{N} \sum_{t=1}^{N} (r_{it}-\bar{r}_i)(r_{jt}-\bar{r}_j)}{Stdev.p_{(i)} = \sqrt{ \frac{1}{N} \sum_{t=1}^{N} (r_{it}-\bar{r}_i)^2 }*Stdev.p_{(j)} = \sqrt{ \frac{1}{N} \sum_{t=1}^{N} (r_{jt}-\bar{r}_j)^2 }}

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

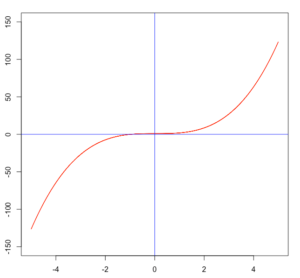

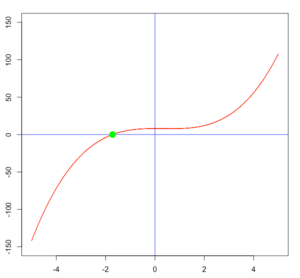

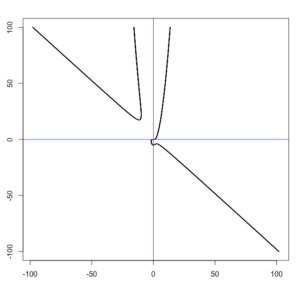

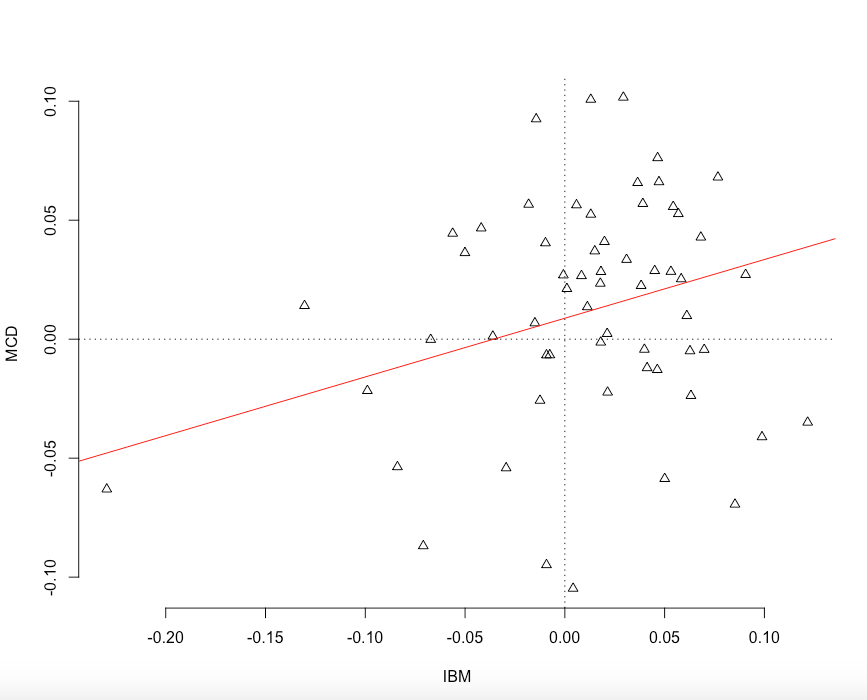

# ploting return series

plot( na.omit(data$IBM.Adj.roc), na.omit(data$MCD.Adj.roc),

xlab = "IBM",

ylab = "MCD", frame.plot = FALSE,

axes = TRUE,

xgap.axis = 4,

ygap.axis = 4,pch=2)

model <- lm( na.omit(data$IBM.Adj.roc) ~ na.omit(data$MCD.Adj.roc) )

abline(model$coefficients, col="red")

abline( h=0, v=0, lty = 3 )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# calculating portfolio performance

data[,3:4]

ratio.ibm <- 0.5

ratio.mcd <- (1 - ratio.ibm)

data[,5] <- NA

data

for(i in 2: length(data[,3]) ){

data[i,5] <- ( data[i,3] * ratio.ibm ) + ( data[i,4] * ratio.mcd )

}

colnames(data)[5] <- "portfolio.performance"

data

head( data )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# portfolio performance values

mean( na.omit( data$portfolio.performance ) )

var( na.omit( data$portfolio.performance ) )

sqrt( var( na.omit( data$portfolio.performance ) ) )

# sd( na.omit( data$portfolio.performance ) )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

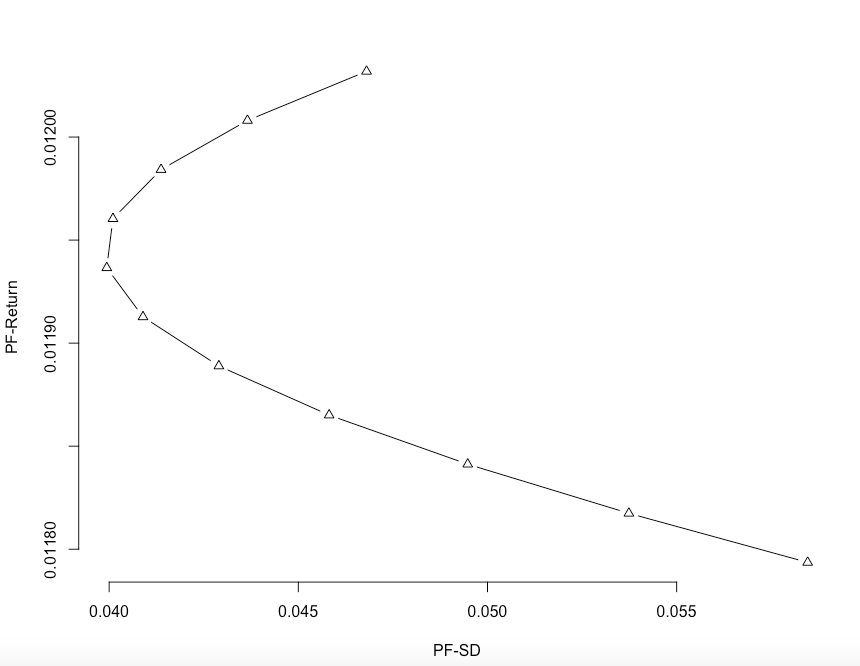

# calculating different portfolios

ratios <- seq( 0, 1, by = 0.1 )

result <- NULL

for(i in 1:length(ratios) ) {

ratio.ibm <- ratios[i]

ratio.mcd <- (1 - ratio.ibm)

data[,5] <- NA

data

for(i in 2: length(data[,3]) ){

data[i,5] <- ( data[i,3] * ratio.ibm ) + ( data[i,4] * ratio.mcd )

}

colnames(data)[5] <- "portfolio.performance"

m <- mean( na.omit( data$portfolio.performance ) )

s <- sqrt( var( na.omit( data$portfolio.performance ) ) )

frame <- data.frame( m, s )

result <- data.frame( rbind( result, frame ) )

}

result

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

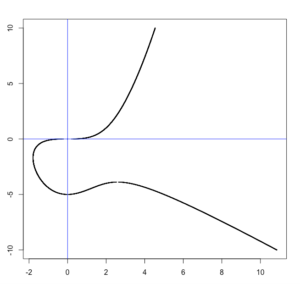

# ploting values

plot( result$s, result$m,

type = "b",

xlab = "PF-SD",

ylab = "PF-Return", frame.plot = FALSE,

axes = TRUE,

xgap.axis = 4,

ygap.axis = 4,pch=2)

#model <- lm( result$m ~ result$s )

#abline(model$coefficients, col="red")

plot( result$s, result$m,

type = "b",

xlim = c(0.035,0.06),

ylim = c(0.0117,0.0122),

xlab = "PF-SD",

ylab = "PF-Return", frame.plot = FALSE,

axes = TRUE,

xgap.axis = 4,

ygap.axis = 4,

pch=2)

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

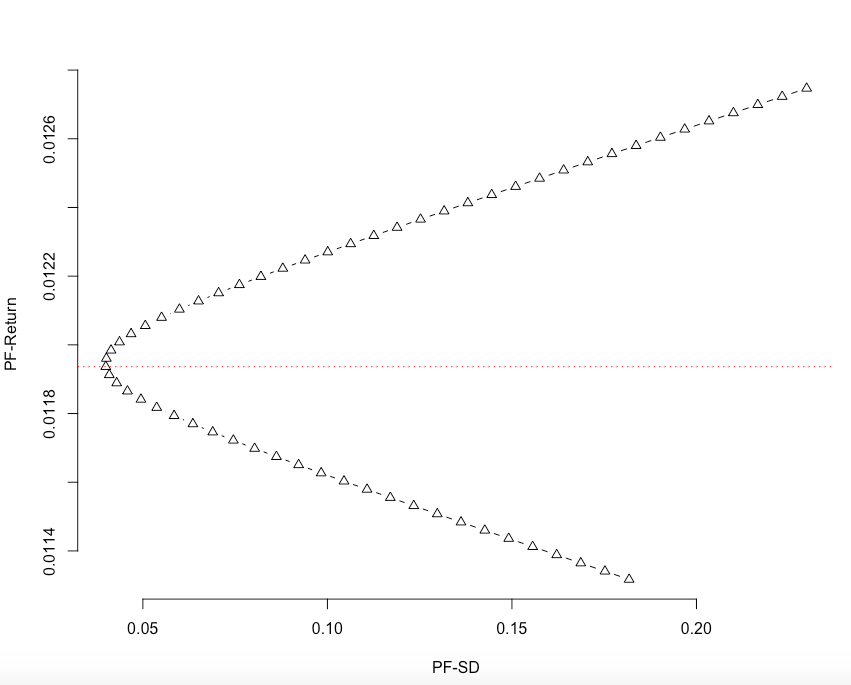

# calculating more portfolios values including the option for shorting

ratios <- seq( -3, 3, by = 0.1 )

result <- NULL

for(i in 1:length(ratios) ) {

ratio.ibm <- ratios[i]

ratio.mcd <- (1 - ratio.ibm)

data[,5] <- NA

data

for(i in 2: length(data[,3]) ){

data[i,5] <- ( data[i,3] * ratio.ibm ) + ( data[i,4] * ratio.mcd )

}

colnames(data)[5] <- "portfolio.performance"

m <- mean( na.omit( data$portfolio.performance ) )

s <- sqrt( var( na.omit( data$portfolio.performance ) ) )

frame <- data.frame( m, s, ratio.ibm, ratio.mcd )

result <- data.frame( rbind( result, frame ) )

}

result

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# ploting values

plot( result$s, result$m,

type = "b",

xlab = "PF-SD",

ylab = "PF-Return", frame.plot = FALSE,

axes = TRUE,

xgap.axis = 4,

ygap.axis = 4,pch=2)

which( round( result$s,4) == round(min( result$s ),4) )

sep.line <- result[which( round( result$s,4) == round(min( result$s ),4) ),1]

abline( h = sep.line , lty = 3, col = "red")

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# The next step would be to calculate values for n asset portfolio

min( result$s )

dplyr::filter( result, s == min( result$s ) )

# - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - #

# latex vector notation

# x=\begin{bmatrix} x_1 \\ x_2 \\ ... \\ x_N \end{bmatrix}