## [1] "year"

## [2] "Access to clean fuels and technologies for cooking (% of population)"

## [3] "Access to electricity (% of population)"

## [4] "Access to electricity, rural (% of rural population)"

## [5] "Access to electricity, urban (% of urban population)"

## [6] "Account ownership at a financial institution or with a mobile-money-service provider (% of population ages 15+)"

## [7] "Account ownership at a financial institution or with a mobile-money-service provider, female (% of population ages 15+)"

## [8] "Account ownership at a financial institution or with a mobile-money-service provider, male (% of population ages 15+)"

## [9] "Account ownership at a financial institution or with a mobile-money-service provider, older adults (% of population ages 25+)"

## [10] "Account ownership at a financial institution or with a mobile-money-service provider, poorest 40% (% of population ages 15+)"

## [11] "Account ownership at a financial institution or with a mobile-money-service provider, primary education or less (% of population ages 15+)"

## [12] "Account ownership at a financial institution or with a mobile-money-service provider, richest 60% (% of population ages 15+)"

## [13] "Account ownership at a financial institution or with a mobile-money-service provider, secondary education or more (% of population ages 15+)"

## [14] "Account ownership at a financial institution or with a mobile-money-service provider, young adults (% of population ages 15-24)"

## [15] "Adequacy of social insurance programs (% of total welfare of beneficiary households)"

## [16] "Adequacy of social protection and labor programs (% of total welfare of beneficiary households)"

## [17] "Adequacy of social safety net programs (% of total welfare of beneficiary households)"

## [18] "Adjusted net enrollment rate, primary (% of primary school age children)"

## [19] "Adjusted net enrollment rate, primary, female (% of primary school age children)"

## [20] "Adjusted net enrollment rate, primary, male (% of primary school age children)"

## [21] "Adjusted net national income (constant 2010 US$)"

## [22] "Adjusted net national income (current US$)"

## [23] "Adjusted net national income per capita (constant 2010 US$)"

## [24] "Adjusted net national income per capita (current US$)"

## [25] "Adjusted net savings, excluding particulate emission damage (% of GNI)"

## [26] "Adjusted net savings, excluding particulate emission damage (current US$)"

## [27] "Adjusted net savings, including particulate emission damage (% of GNI)"

## [28] "Adjusted net savings, including particulate emission damage (current US$)"

## [29] "Adjusted savings: carbon dioxide damage (% of GNI)"

## [30] "Adjusted savings: carbon dioxide damage (current US$)"

## [31] "Adjusted savings: consumption of fixed capital (% of GNI)"

## [32] "Adjusted savings: consumption of fixed capital (current US$)"

## [33] "Adjusted savings: education expenditure (% of GNI)"

## [34] "Adjusted savings: education expenditure (current US$)"

## [35] "Adjusted savings: energy depletion (% of GNI)"

## [36] "Adjusted savings: energy depletion (current US$)"

## [37] "Adjusted savings: gross savings (% of GNI)"

## [38] "Adjusted savings: mineral depletion (% of GNI)"

## [39] "Adjusted savings: mineral depletion (current US$)"

## [40] "Adjusted savings: natural resources depletion (% of GNI)"

## [41] "Adjusted savings: net forest depletion (% of GNI)"

## [42] "Adjusted savings: net forest depletion (current US$)"

## [43] "Adjusted savings: net national savings (% of GNI)"

## [44] "Adjusted savings: net national savings (current US$)"

## [45] "Adjusted savings: particulate emission damage (% of GNI)"

## [46] "Adjusted savings: particulate emission damage (current US$)"

## [47] "Adolescent fertility rate (births per 1,000 women ages 15-19)"

## [48] "Adolescents out of school (% of lower secondary school age)"

## [49] "Adolescents out of school, female (% of female lower secondary school age)"

## [50] "Adolescents out of school, male (% of male lower secondary school age)"

## [51] "Adults (ages 15+) and children (ages 0-14) newly infected with HIV"

## [52] "Adults (ages 15+) newly infected with HIV"

## [53] "Age dependency ratio (% of working-age population)"

## [54] "Age dependency ratio, old (% of working-age population)"

## [55] "Age dependency ratio, young (% of working-age population)"

## [56] "Agricultural irrigated land (% of total agricultural land)"

## [57] "Agricultural land (% of land area)"

## [58] "Agricultural land (sq. km)"

## [59] "Agricultural machinery, tractors"

## [60] "Agricultural machinery, tractors per 100 sq. km of arable land"

## [61] "Agricultural methane emissions (% of total)"

## [62] "Agricultural methane emissions (thousand metric tons of CO2 equivalent)"

## [63] "Agricultural nitrous oxide emissions (% of total)"

## [64] "Agricultural nitrous oxide emissions (thousand metric tons of CO2 equivalent)"

## [65] "Agricultural raw materials exports (% of merchandise exports)"

## [66] "Agricultural raw materials imports (% of merchandise imports)"

## [67] "Agriculture, forestry, and fishing, value added (% of GDP)"

## [68] "Agriculture, forestry, and fishing, value added (annual % growth)"

## [69] "Agriculture, forestry, and fishing, value added (constant 2010 US$)"

## [70] "Agriculture, forestry, and fishing, value added (constant LCU)"

## [71] "Agriculture, forestry, and fishing, value added (current LCU)"

## [72] "Agriculture, forestry, and fishing, value added (current US$)"

## [73] "Agriculture, forestry, and fishing, value added per worker (constant 2010 US$)"

## [74] "Air transport, freight (million ton-km)"

## [75] "Air transport, passengers carried"

## [76] "Air transport, registered carrier departures worldwide"

## [77] "Annual freshwater withdrawals, agriculture (% of total freshwater withdrawal)"

## [78] "Annual freshwater withdrawals, domestic (% of total freshwater withdrawal)"

## [79] "Annual freshwater withdrawals, industry (% of total freshwater withdrawal)"

## [80] "Annual freshwater withdrawals, total (% of internal resources)"

## [81] "Annual freshwater withdrawals, total (billion cubic meters)"

## [82] "Antiretroviral therapy coverage (% of people living with HIV)"

## [83] "Antiretroviral therapy coverage for PMTCT (% of pregnant women living with HIV)"

## [84] "Aquaculture production (metric tons)"

## [85] "Arable land (% of land area)"

## [86] "Arable land (hectares per person)"

## [87] "Arable land (hectares)"

## [88] "ARI treatment (% of children under 5 taken to a health provider)"

## [89] "Armed forces personnel (% of total labor force)"

## [90] "Armed forces personnel, total"

## [91] "Arms exports (SIPRI trend indicator values)"

## [92] "Arms imports (SIPRI trend indicator values)"

## [93] "Automated teller machines (ATMs) (per 100,000 adults)"

## [94] "Average number of visits or required meetings with tax officials (for affected firms)"

## [95] "Average precipitation in depth (mm per year)"

## [96] "Average time to clear exports through customs (days)"

## [97] "Average transaction cost of sending remittances to a specific country (%)"

## [98] "Average working hours of children, study and work, ages 7-14 (hours per week)"

## [99] "Average working hours of children, study and work, female, ages 7-14 (hours per week)"

## [100] "Average working hours of children, study and work, male, ages 7-14 (hours per week)"

## [101] "Average working hours of children, working only, ages 7-14 (hours per week)"

## [102] "Average working hours of children, working only, female, ages 7-14 (hours per week)"

## [103] "Average working hours of children, working only, male, ages 7-14 (hours per week)"

## [104] "Bank capital to assets ratio (%)"

## [105] "Bank liquid reserves to bank assets ratio (%)"

## [106] "Bank nonperforming loans to total gross loans (%)"

## [107] "Battle-related deaths (number of people)"

## [108] "Benefit incidence of social insurance programs to poorest quintile (% of total social insurance benefits)"

## [109] "Benefit incidence of social protection and labor programs to poorest quintile (% of total SPL benefits)"

## [110] "Benefit incidence of social safety net programs to poorest quintile (% of total safety net benefits)"

## [111] "Binding coverage, all products (%)"

## [112] "Binding coverage, manufactured products (%)"

## [113] "Binding coverage, primary products (%)"

## [114] "Bird species, threatened"

## [115] "Birth rate, crude (per 1,000 people)"

## [116] "Births attended by skilled health staff (% of total)"

## [117] "Borrowers from commercial banks (per 1,000 adults)"

## [118] "Bound rate, simple mean, all products (%)"

## [119] "Bound rate, simple mean, manufactured products (%)"

## [120] "Bound rate, simple mean, primary products (%)"

## [121] "Bribery incidence (% of firms experiencing at least one bribe payment request)"

## [122] "Broad money (% of GDP)"

## [123] "Broad money (current LCU)"

## [124] "Broad money growth (annual %)"

## [125] "Broad money to total reserves ratio"

## [126] "Business extent of disclosure index (0=less disclosure to 10=more disclosure)"

## [127] "Capture fisheries production (metric tons)"

## [128] "Cause of death, by communicable diseases and maternal, prenatal and nutrition conditions (% of total)"

## [129] "Cause of death, by injury (% of total)"

## [130] "Cause of death, by non-communicable diseases (% of total)"

## [131] "Cereal production (metric tons)"

## [132] "Cereal yield (kg per hectare)"

## [133] "Charges for the use of intellectual property, payments (BoP, current US$)"

## [134] "Charges for the use of intellectual property, receipts (BoP, current US$)"

## [135] "Children (0-14) living with HIV"

## [136] "Children (ages 0-14) newly infected with HIV"

## [137] "Children in employment, female (% of female children ages 7-14)"

## [138] "Children in employment, male (% of male children ages 7-14)"

## [139] "Children in employment, study and work (% of children in employment, ages 7-14)"

## [140] "Children in employment, study and work, female (% of female children in employment, ages 7-14)"

## [141] "Children in employment, study and work, male (% of male children in employment, ages 7-14)"

## [142] "Children in employment, total (% of children ages 7-14)"

## [143] "Children in employment, unpaid family workers (% of children in employment, ages 7-14)"

## [144] "Children in employment, unpaid family workers, female (% of female children in employment, ages 7-14)"

## [145] "Children in employment, unpaid family workers, male (% of male children in employment, ages 7-14)"

## [146] "Children in employment, wage workers (% of children in employment, ages 7-14)"

## [147] "Children in employment, wage workers, female (% of female children in employment, ages 7-14)"

## [148] "Children in employment, wage workers, male (% of male children in employment, ages 7-14)"

## [149] "Children in employment, work only (% of children in employment, ages 7-14)"

## [150] "Children in employment, work only, female (% of female children in employment, ages 7-14)"

## [151] "Children in employment, work only, male (% of male children in employment, ages 7-14)"

## [152] "Children out of school (% of primary school age)"

## [153] "Children out of school, female (% of female primary school age)"

## [154] "Children out of school, male (% of male primary school age)"

## [155] "Children out of school, primary"

## [156] "Children out of school, primary, female"

## [157] "Children out of school, primary, male"

## [158] "Children with fever receiving antimalarial drugs (% of children under age 5 with fever)"

## [159] "Claims on central government (annual growth as % of broad money)"

## [160] "Claims on central government, etc. (% GDP)"

## [161] "Claims on other sectors of the domestic economy (annual growth as % of broad money)"

## [162] "Claims on private sector (annual growth as % of broad money)"

## [163] "CO2 emissions (kg per 2010 US$ of GDP)"

## [164] "CO2 emissions (kg per 2017 PPP $ of GDP)"

## [165] "CO2 emissions (kg per PPP $ of GDP)"

## [166] "CO2 emissions (kt)"

## [167] "CO2 emissions (metric tons per capita)"

## [168] "CO2 emissions from gaseous fuel consumption (% of total)"

## [169] "CO2 emissions from gaseous fuel consumption (kt)"

## [170] "CO2 emissions from liquid fuel consumption (% of total)"

## [171] "CO2 emissions from liquid fuel consumption (kt)"

## [172] "CO2 emissions from solid fuel consumption (% of total)"

## [173] "CO2 emissions from solid fuel consumption (kt)"

## [174] "Coal rents (% of GDP)"

## [175] "Commercial bank branches (per 100,000 adults)"

## [176] "Commercial banks and other lending (PPG + PNG) (NFL, current US$)"

## [177] "Commercial service exports (current US$)"

## [178] "Commercial service imports (current US$)"

## [179] "Communications, computer, etc. (% of service exports, BoP)"

## [180] "Communications, computer, etc. (% of service imports, BoP)"

## [181] "Compensation of employees (% of expense)"

## [182] "Compensation of employees (current LCU)"

## [183] "Completeness of birth registration (%)"

## [184] "Completeness of birth registration, female (%)"

## [185] "Completeness of birth registration, male (%)"

## [186] "Completeness of birth registration, rural (%)"

## [187] "Completeness of birth registration, urban (%)"

## [188] "Compulsory education, duration (years)"

## [189] "Computer, communications and other services (% of commercial service exports)"

## [190] "Computer, communications and other services (% of commercial service imports)"

## [191] "Consumer price index (2010 = 100)"

## [192] "Consumption of iodized salt (% of households)"

## [193] "Contraceptive prevalence, any methods (% of women ages 15-49)"

## [194] "Contraceptive prevalence, modern methods (% of women ages 15-49)"

## [195] "Contributing family workers, female (% of female employment) (modeled ILO estimate)"

## [196] "Contributing family workers, male (% of male employment) (modeled ILO estimate)"

## [197] "Contributing family workers, total (% of total employment) (modeled ILO estimate)"

## [198] "Cost of business start-up procedures (% of GNI per capita)"

## [199] "Cost of business start-up procedures, female (% of GNI per capita)"

## [200] "Cost of business start-up procedures, male (% of GNI per capita)"

## [201] "Cost to export, border compliance (US$)"

## [202] "Cost to export, documentary compliance (US$)"

## [203] "Cost to import, border compliance (US$)"

## [204] "Cost to import, documentary compliance (US$)"

## [205] "Coverage of social insurance programs (% of population)"

## [206] "Coverage of social insurance programs in 2nd quintile (% of population)"

## [207] "Coverage of social insurance programs in 3rd quintile (% of population)"

## [208] "Coverage of social insurance programs in 4th quintile (% of population)"

## [209] "Coverage of social insurance programs in poorest quintile (% of population)"

## [210] "Coverage of social insurance programs in richest quintile (% of population)"

## [211] "Coverage of social protection and labor programs (% of population)"

## [212] "Coverage of social safety net programs (% of population)"

## [213] "Coverage of social safety net programs in 2nd quintile (% of population)"

## [214] "Coverage of social safety net programs in 3rd quintile (% of population)"

## [215] "Coverage of social safety net programs in 4th quintile (% of population)"

## [216] "Coverage of social safety net programs in poorest quintile (% of population)"

## [217] "Coverage of social safety net programs in richest quintile (% of population)"

## [218] "CPIA building human resources rating (1=low to 6=high)"

## [219] "CPIA business regulatory environment rating (1=low to 6=high)"

## [220] "CPIA debt policy rating (1=low to 6=high)"

## [221] "CPIA economic management cluster average (1=low to 6=high)"

## [222] "CPIA efficiency of revenue mobilization rating (1=low to 6=high)"

## [223] "CPIA equity of public resource use rating (1=low to 6=high)"

## [224] "CPIA financial sector rating (1=low to 6=high)"

## [225] "CPIA fiscal policy rating (1=low to 6=high)"

## [226] "CPIA gender equality rating (1=low to 6=high)"

## [227] "CPIA macroeconomic management rating (1=low to 6=high)"

## [228] "CPIA policies for social inclusion/equity cluster average (1=low to 6=high)"

## [229] "CPIA policy and institutions for environmental sustainability rating (1=low to 6=high)"

## [230] "CPIA property rights and rule-based governance rating (1=low to 6=high)"

## [231] "CPIA public sector management and institutions cluster average (1=low to 6=high)"

## [232] "CPIA quality of budgetary and financial management rating (1=low to 6=high)"

## [233] "CPIA quality of public administration rating (1=low to 6=high)"

## [234] "CPIA social protection rating (1=low to 6=high)"

## [235] "CPIA structural policies cluster average (1=low to 6=high)"

## [236] "CPIA trade rating (1=low to 6=high)"

## [237] "CPIA transparency, accountability, and corruption in the public sector rating (1=low to 6=high)"

## [238] "Crop production index (2004-2006 = 100)"

## [239] "Current account balance (% of GDP)"

## [240] "Current account balance (BoP, current US$)"

## [241] "Current education expenditure, primary (% of total expenditure in primary public institutions)"

## [242] "Current education expenditure, secondary (% of total expenditure in secondary public institutions)"

## [243] "Current education expenditure, tertiary (% of total expenditure in tertiary public institutions)"

## [244] "Current education expenditure, total (% of total expenditure in public institutions)"

## [245] "Current health expenditure (% of GDP)"

## [246] "Current health expenditure per capita (current US$)"

## [247] "Current health expenditure per capita, PPP (current international $)"

## [248] "Customs and other import duties (% of tax revenue)"

## [249] "Customs and other import duties (current LCU)"

## [250] "Death rate, crude (per 1,000 people)"

## [251] "Debt service (PPG and IMF only, % of exports of goods, services and primary income)"

## [252] "Debt service on external debt, public and publicly guaranteed (PPG) (TDS, current US$)"

## [253] "Debt service on external debt, total (TDS, current US$)"

## [254] "DEC alternative conversion factor (LCU per US$)"

## [255] "Demand for family planning satisfied by modern methods (% of married women with demand for family planning)"

## [256] "Depositors with commercial banks (per 1,000 adults)"

## [257] "Depth of credit information index (0=low to 8=high)"

## [258] "Diabetes prevalence (% of population ages 20 to 79)"

## [259] "Diarrhea treatment (% of children under 5 receiving oral rehydration and continued feeding)"

## [260] "Diarrhea treatment (% of children under 5 who received ORS packet)"

## [261] "Discrepancy in expenditure estimate of GDP (current LCU)"

## [262] "Domestic credit to private sector (% of GDP)"

## [263] "Domestic credit to private sector by banks (% of GDP)"

## [264] "Domestic general government health expenditure (% of current health expenditure)"

## [265] "Domestic general government health expenditure (% of GDP)"

## [266] "Domestic general government health expenditure (% of general government expenditure)"

## [267] "Domestic general government health expenditure per capita (current US$)"

## [268] "Domestic general government health expenditure per capita, PPP (current international $)"

## [269] "Domestic private health expenditure (% of current health expenditure)"

## [270] "Domestic private health expenditure per capita (current US$)"

## [271] "Domestic private health expenditure per capita, PPP (current international $)"

## [272] "Droughts, floods, extreme temperatures (% of population, average 1990-2009)"

## [273] "Ease of doing business index (1=most business-friendly regulations)"

## [274] "Ease of doing business score (0 = lowest performance to 100 = best performance)"

## [275] "Educational attainment, at least completed lower secondary, population 25+, female (%) (cumulative)"

## [276] "Educational attainment, at least completed lower secondary, population 25+, male (%) (cumulative)"

## [277] "Educational attainment, at least completed lower secondary, population 25+, total (%) (cumulative)"

## [278] "Educational attainment, at least completed post-secondary, population 25+, female (%) (cumulative)"

## [279] "Educational attainment, at least completed post-secondary, population 25+, male (%) (cumulative)"

## [280] "Educational attainment, at least completed post-secondary, population 25+, total (%) (cumulative)"

## [281] "Educational attainment, at least completed primary, population 25+ years, female (%) (cumulative)"

## [282] "Educational attainment, at least completed primary, population 25+ years, male (%) (cumulative)"

## [283] "Educational attainment, at least completed primary, population 25+ years, total (%) (cumulative)"

## [284] "Educational attainment, at least completed upper secondary, population 25+, female (%) (cumulative)"

## [285] "Educational attainment, at least completed upper secondary, population 25+, male (%) (cumulative)"

## [286] "Educational attainment, at least completed upper secondary, population 25+, total (%) (cumulative)"

## [287] "Employers, female (% of female employment) (modeled ILO estimate)"

## [288] "Employers, male (% of male employment) (modeled ILO estimate)"

## [289] "Employers, total (% of total employment) (modeled ILO estimate)"

## [290] "Employment in agriculture (% of total employment) (modeled ILO estimate)"

## [291] "Employment in agriculture, female (% of female employment) (modeled ILO estimate)"

## [292] "Employment in agriculture, male (% of male employment) (modeled ILO estimate)"

## [293] "Employment in industry (% of total employment) (modeled ILO estimate)"

## [294] "Employment in industry, female (% of female employment) (modeled ILO estimate)"

## [295] "Employment in industry, male (% of male employment) (modeled ILO estimate)"

## [296] "Employment in services (% of total employment) (modeled ILO estimate)"

## [297] "Employment in services, female (% of female employment) (modeled ILO estimate)"

## [298] "Employment in services, male (% of male employment) (modeled ILO estimate)"

## [299] "Employment to population ratio, 15+, female (%) (modeled ILO estimate)"

## [300] "Employment to population ratio, 15+, female (%) (national estimate)"

## [301] "Employment to population ratio, 15+, male (%) (modeled ILO estimate)"

## [302] "Employment to population ratio, 15+, male (%) (national estimate)"

## [303] "Employment to population ratio, 15+, total (%) (modeled ILO estimate)"

## [304] "Employment to population ratio, 15+, total (%) (national estimate)"

## [305] "Employment to population ratio, ages 15-24, female (%) (modeled ILO estimate)"

## [306] "Employment to population ratio, ages 15-24, female (%) (national estimate)"

## [307] "Employment to population ratio, ages 15-24, male (%) (modeled ILO estimate)"

## [308] "Employment to population ratio, ages 15-24, male (%) (national estimate)"

## [309] "Employment to population ratio, ages 15-24, total (%) (modeled ILO estimate)"

## [310] "Employment to population ratio, ages 15-24, total (%) (national estimate)"

## [311] "Energy intensity level of primary energy (MJ/$2011 PPP GDP)"

## [312] "Energy related methane emissions (% of total)"

## [313] "Exclusive breastfeeding (% of children under 6 months)"

## [314] "Expenditure on primary education (% of government expenditure on education)"

## [315] "Expenditure on secondary education (% of government expenditure on education)"

## [316] "Expenditure on tertiary education (% of government expenditure on education)"

## [317] "Expense (% of GDP)"

## [318] "Expense (current LCU)"

## [319] "Export unit value index (2000 = 100)"

## [320] "Export value index (2000 = 100)"

## [321] "Export volume index (2000 = 100)"

## [322] "Exports of goods and services (% of GDP)"

## [323] "Exports of goods and services (BoP, current US$)"

## [324] "Exports of goods and services (constant 2010 US$)"

## [325] "Exports of goods and services (current LCU)"

## [326] "Exports of goods and services (current US$)"

## [327] "Exports of goods, services and primary income (BoP, current US$)"

## [328] "External balance on goods and services (% of GDP)"

## [329] "External balance on goods and services (current LCU)"

## [330] "External balance on goods and services (current US$)"

## [331] "External debt stocks (% of GNI)"

## [332] "External debt stocks, long-term (DOD, current US$)"

## [333] "External debt stocks, private nonguaranteed (PNG) (DOD, current US$)"

## [334] "External debt stocks, public and publicly guaranteed (PPG) (DOD, current US$)"

## [335] "External debt stocks, short-term (DOD, current US$)"

## [336] "External debt stocks, total (DOD, current US$)"

## [337] "External health expenditure (% of current health expenditure)"

## [338] "External health expenditure per capita (current US$)"

## [339] "External health expenditure per capita, PPP (current international $)"

## [340] "Female headed households (% of households with a female head)"

## [341] "Female share of employment in senior and middle management (%)"

## [342] "Fertility rate, total (births per woman)"

## [343] "Fertilizer consumption (% of fertilizer production)"

## [344] "Fertilizer consumption (kilograms per hectare of arable land)"

## [345] "Final consumption expenditure (% of GDP)"

## [346] "Final consumption expenditure (constant 2010 US$)"

## [347] "Final consumption expenditure (current LCU)"

## [348] "Final consumption expenditure (current US$)"

## [349] "Firms competing against unregistered firms (% of firms)"

## [350] "Firms expected to give gifts in meetings with tax officials (% of firms)"

## [351] "Firms experiencing electrical outages (% of firms)"

## [352] "Firms experiencing losses due to theft and vandalism (% of firms)"

## [353] "Firms formally registered when operations started (% of firms)"

## [354] "Firms offering formal training (% of firms)"

## [355] "Firms that spend on R&D (% of firms)"

## [356] "Firms using banks to finance investment (% of firms)"

## [357] "Firms using banks to finance working capital (% of firms)"

## [358] "Firms visited or required meetings with tax officials (% of firms)"

## [359] "Firms with female participation in ownership (% of firms)"

## [360] "Firms with female top manager (% of firms)"

## [361] "Fish species, threatened"

## [362] "Fixed broadband subscriptions"

## [363] "Fixed broadband subscriptions (per 100 people)"

## [364] "Fixed telephone subscriptions"

## [365] "Fixed telephone subscriptions (per 100 people)"

## [366] "Food exports (% of merchandise exports)"

## [367] "Food imports (% of merchandise imports)"

## [368] "Food production index (2004-2006 = 100)"

## [369] "Foreign direct investment, net (BoP, current US$)"

## [370] "Foreign direct investment, net inflows (% of GDP)"

## [371] "Foreign direct investment, net inflows (BoP, current US$)"

## [372] "Foreign direct investment, net outflows (% of GDP)"

## [373] "Foreign direct investment, net outflows (BoP, current US$)"

## [374] "Forest area (% of land area)"

## [375] "Forest area (sq. km)"

## [376] "Forest rents (% of GDP)"

## [377] "Fuel exports (% of merchandise exports)"

## [378] "Fuel imports (% of merchandise imports)"

## [379] "GDP (constant 2010 US$)"

## [380] "GDP (constant LCU)"

## [381] "GDP (current LCU)"

## [382] "GDP (current US$)"

## [383] "GDP deflator (base year varies by country)"

## [384] "GDP deflator: linked series (base year varies by country)"

## [385] "GDP growth (annual %)"

## [386] "GDP per capita (constant 2010 US$)"

## [387] "GDP per capita (constant LCU)"

## [388] "GDP per capita (current LCU)"

## [389] "GDP per capita (current US$)"

## [390] "GDP per capita growth (annual %)"

## [391] "GDP per capita, PPP (constant 2017 international $)"

## [392] "GDP per capita, PPP (current international $)"

## [393] "GDP per person employed (constant 2017 PPP $)"

## [394] "GDP, PPP (constant 2017 international $)"

## [395] "GDP, PPP (current international $)"

## [396] "GDP: linked series (current LCU)"

## [397] "General government final consumption expenditure (% of GDP)"

## [398] "General government final consumption expenditure (constant 2010 US$)"

## [399] "General government final consumption expenditure (current LCU)"

## [400] "General government final consumption expenditure (current US$)"

## [401] "GNI (constant 2010 US$)"

## [402] "GNI (current LCU)"

## [403] "GNI (current US$)"

## [404] "GNI per capita (constant 2010 US$)"

## [405] "GNI per capita (current LCU)"

## [406] "GNI per capita, Atlas method (current US$)"

## [407] "GNI per capita, PPP (constant 2017 international $)"

## [408] "GNI per capita, PPP (current international $)"

## [409] "GNI, Atlas method (current US$)"

## [410] "GNI, PPP (constant 2017 international $)"

## [411] "GNI, PPP (current international $)"

## [412] "GNI: linked series (current LCU)"

## [413] "Goods and services expense (% of expense)"

## [414] "Goods and services expense (current LCU)"

## [415] "Goods exports (BoP, current US$)"

## [416] "Goods imports (BoP, current US$)"

## [417] "Government expenditure on education, total (% of GDP)"

## [418] "Government expenditure on education, total (% of government expenditure)"

## [419] "Government expenditure per student, primary (% of GDP per capita)"

## [420] "Government expenditure per student, secondary (% of GDP per capita)"

## [421] "Government expenditure per student, tertiary (% of GDP per capita)"

## [422] "Grants and other revenue (% of revenue)"

## [423] "Grants and other revenue (current LCU)"

## [424] "Grants, excluding technical cooperation (BoP, current US$)"

## [425] "Gross capital formation (% of GDP)"

## [426] "Gross capital formation (constant 2010 US$)"

## [427] "Gross capital formation (current LCU)"

## [428] "Gross capital formation (current US$)"

## [429] "Gross domestic savings (% of GDP)"

## [430] "Gross domestic savings (current LCU)"

## [431] "Gross domestic savings (current US$)"

## [432] "Gross fixed capital formation (% of GDP)"

## [433] "Gross fixed capital formation (constant 2010 US$)"

## [434] "Gross fixed capital formation (current LCU)"

## [435] "Gross fixed capital formation (current US$)"

## [436] "Gross intake ratio in first grade of primary education, female (% of relevant age group)"

## [437] "Gross intake ratio in first grade of primary education, male (% of relevant age group)"

## [438] "Gross intake ratio in first grade of primary education, total (% of relevant age group)"

## [439] "Gross national expenditure (% of GDP)"

## [440] "Gross national expenditure (constant 2010 US$)"

## [441] "Gross national expenditure (current LCU)"

## [442] "Gross national expenditure (current US$)"

## [443] "Gross savings (% of GDP)"

## [444] "Gross savings (% of GNI)"

## [445] "Gross savings (current LCU)"

## [446] "Gross savings (current US$)"

## [447] "Gross value added at basic prices (GVA) (constant 2010 US$)"

## [448] "Gross value added at basic prices (GVA) (constant LCU)"

## [449] "Gross value added at basic prices (GVA) (current LCU)"

## [450] "Gross value added at basic prices (GVA) (current US$)"

## [451] "Hospital beds (per 1,000 people)"

## [452] "Households and NPISHs final consumption expenditure (% of GDP)"

## [453] "Households and NPISHs Final consumption expenditure (constant 2010 US$)"

## [454] "Households and NPISHs Final consumption expenditure (current LCU)"

## [455] "Households and NPISHs Final consumption expenditure (current US$)"

## [456] "Households and NPISHs Final consumption expenditure per capita (constant 2010 US$)"

## [457] "Households and NPISHs Final consumption expenditure, PPP (constant 2017 international $)"

## [458] "Households and NPISHs Final consumption expenditure, PPP (current international $)"

## [459] "Households and NPISHs final consumption expenditure: linked series (current LCU)"

## [460] "Human capital index (HCI) (scale 0-1)"

## [461] "Human capital index (HCI), female (scale 0-1)"

## [462] "Human capital index (HCI), female, lower bound (scale 0-1)"

## [463] "Human capital index (HCI), female, upper bound (scale 0-1)"

## [464] "Human capital index (HCI), lower bound (scale 0-1)"

## [465] "Human capital index (HCI), male (scale 0-1)"

## [466] "Human capital index (HCI), male, lower bound (scale 0-1)"

## [467] "Human capital index (HCI), male, upper bound (scale 0-1)"

## [468] "Human capital index (HCI), upper bound (scale 0-1)"

## [469] "IBRD loans and IDA credits (DOD, current US$)"

## [470] "ICT goods imports (% total goods imports)"

## [471] "ICT service exports (% of service exports, BoP)"

## [472] "ICT service exports (BoP, current US$)"

## [473] "IDA resource allocation index (1=low to 6=high)"

## [474] "IFC, private nonguaranteed (NFL, current US$)"

## [475] "IMF repurchases and charges (TDS, current US$)"

## [476] "Immunization, DPT (% of children ages 12-23 months)"

## [477] "Immunization, HepB3 (% of one-year-old children)"

## [478] "Immunization, measles (% of children ages 12-23 months)"

## [479] "Import unit value index (2000 = 100)"

## [480] "Import value index (2000 = 100)"

## [481] "Import volume index (2000 = 100)"

## [482] "Imports of goods and services (% of GDP)"

## [483] "Imports of goods and services (BoP, current US$)"

## [484] "Imports of goods and services (constant 2010 US$)"

## [485] "Imports of goods and services (current LCU)"

## [486] "Imports of goods and services (current US$)"

## [487] "Imports of goods, services and primary income (BoP, current US$)"

## [488] "Incidence of HIV (per 1,000 uninfected population ages 15-49)"

## [489] "Incidence of malaria (per 1,000 population at risk)"

## [490] "Incidence of tuberculosis (per 100,000 people)"

## [491] "Increase in poverty gap at $1.90 ($ 2011 PPP) poverty line due to out-of-pocket health care expenditure (% of poverty line)"

## [492] "Increase in poverty gap at $1.90 ($ 2011 PPP) poverty line due to out-of-pocket health care expenditure (USD)"

## [493] "Increase in poverty gap at $3.20 ($ 2011 PPP) poverty line due to out-of-pocket health care expenditure (% of poverty line)"

## [494] "Increase in poverty gap at $3.20 ($ 2011 PPP) poverty line due to out-of-pocket health care expenditure (USD)"

## [495] "Individuals using the Internet (% of population)"

## [496] "Industry (including construction), value added (% of GDP)"

## [497] "Industry (including construction), value added (annual % growth)"

## [498] "Industry (including construction), value added (constant 2010 US$)"

## [499] "Industry (including construction), value added (constant LCU)"

## [500] "Industry (including construction), value added (current LCU)"

## [501] "Industry (including construction), value added (current US$)"

## [502] "Industry (including construction), value added per worker (constant 2010 US$)"

## [503] "Inflation, consumer prices (annual %)"

## [504] "Inflation, GDP deflator (annual %)"

## [505] "Inflation, GDP deflator: linked series (annual %)"

## [506] "Informal payments to public officials (% of firms)"

## [507] "Insurance and financial services (% of commercial service exports)"

## [508] "Insurance and financial services (% of commercial service imports)"

## [509] "Insurance and financial services (% of service exports, BoP)"

## [510] "Insurance and financial services (% of service imports, BoP)"

## [511] "Intentional homicides (per 100,000 people)"

## [512] "Interest payments (% of expense)"

## [513] "Interest payments (% of revenue)"

## [514] "Interest payments (current LCU)"

## [515] "Internally displaced persons, new displacement associated with conflict and violence (number of cases)"

## [516] "Internally displaced persons, new displacement associated with disasters (number of cases)"

## [517] "Internally displaced persons, total displaced by conflict and violence (number of people)"

## [518] "International migrant stock (% of population)"

## [519] "International migrant stock, total"

## [520] "International tourism, expenditures (% of total imports)"

## [521] "International tourism, expenditures (current US$)"

## [522] "International tourism, expenditures for passenger transport items (current US$)"

## [523] "International tourism, expenditures for travel items (current US$)"

## [524] "International tourism, receipts (% of total exports)"

## [525] "International tourism, receipts (current US$)"

## [526] "International tourism, receipts for passenger transport items (current US$)"

## [527] "International tourism, receipts for travel items (current US$)"

## [528] "Investment in energy with private participation (current US$)"

## [529] "Labor force participation rate for ages 15-24, female (%) (modeled ILO estimate)"

## [530] "Labor force participation rate for ages 15-24, female (%) (national estimate)"

## [531] "Labor force participation rate for ages 15-24, male (%) (modeled ILO estimate)"

## [532] "Labor force participation rate for ages 15-24, male (%) (national estimate)"

## [533] "Labor force participation rate for ages 15-24, total (%) (modeled ILO estimate)"

## [534] "Labor force participation rate for ages 15-24, total (%) (national estimate)"

## [535] "Labor force participation rate, female (% of female population ages 15-64) (modeled ILO estimate)"

## [536] "Labor force participation rate, female (% of female population ages 15+) (modeled ILO estimate)"

## [537] "Labor force participation rate, female (% of female population ages 15+) (national estimate)"

## [538] "Labor force participation rate, male (% of male population ages 15-64) (modeled ILO estimate)"

## [539] "Labor force participation rate, male (% of male population ages 15+) (modeled ILO estimate)"

## [540] "Labor force participation rate, male (% of male population ages 15+) (national estimate)"

## [541] "Labor force participation rate, total (% of total population ages 15-64) (modeled ILO estimate)"

## [542] "Labor force participation rate, total (% of total population ages 15+) (modeled ILO estimate)"

## [543] "Labor force participation rate, total (% of total population ages 15+) (national estimate)"

## [544] "Labor force with advanced education (% of total working-age population with advanced education)"

## [545] "Labor force with advanced education, female (% of female working-age population with advanced education)"

## [546] "Labor force with advanced education, male (% of male working-age population with advanced education)"

## [547] "Labor force with basic education (% of total working-age population with basic education)"

## [548] "Labor force with basic education, female (% of female working-age population with basic education)"

## [549] "Labor force with basic education, male (% of male working-age population with basic education)"

## [550] "Labor force with intermediate education (% of total working-age population with intermediate education)"

## [551] "Labor force with intermediate education, female (% of female working-age population with intermediate education)"

## [552] "Labor force with intermediate education, male (% of male working-age population with intermediate education)"

## [553] "Labor force, female (% of total labor force)"

## [554] "Labor force, total"

## [555] "Labor tax and contributions (% of commercial profits)"

## [556] "Land area (sq. km)"

## [557] "Land under cereal production (hectares)"

## [558] "Lead time to export, median case (days)"

## [559] "Lead time to import, median case (days)"

## [560] "Lending interest rate (%)"

## [561] "Level of water stress: freshwater withdrawal as a proportion of available freshwater resources"

## [562] "Life expectancy at birth, female (years)"

## [563] "Life expectancy at birth, male (years)"

## [564] "Life expectancy at birth, total (years)"

## [565] "Lifetime risk of maternal death (%)"

## [566] "Lifetime risk of maternal death (1 in: rate varies by country)"

## [567] "Literacy rate, adult female (% of females ages 15 and above)"

## [568] "Literacy rate, adult male (% of males ages 15 and above)"

## [569] "Literacy rate, adult total (% of people ages 15 and above)"

## [570] "Literacy rate, youth (ages 15-24), gender parity index (GPI)"

## [571] "Literacy rate, youth female (% of females ages 15-24)"

## [572] "Literacy rate, youth male (% of males ages 15-24)"

## [573] "Literacy rate, youth total (% of people ages 15-24)"

## [574] "Livestock production index (2004-2006 = 100)"

## [575] "Logistics performance index: Ability to track and trace consignments (1=low to 5=high)"

## [576] "Logistics performance index: Competence and quality of logistics services (1=low to 5=high)"

## [577] "Logistics performance index: Ease of arranging competitively priced shipments (1=low to 5=high)"

## [578] "Logistics performance index: Efficiency of customs clearance process (1=low to 5=high)"

## [579] "Logistics performance index: Frequency with which shipments reach consignee within scheduled or expected time (1=low to 5=high)"

## [580] "Logistics performance index: Overall (1=low to 5=high)"

## [581] "Logistics performance index: Quality of trade and transport-related infrastructure (1=low to 5=high)"

## [582] "Losses due to theft and vandalism (% of annual sales of affected firms)"

## [583] "Lower secondary completion rate, female (% of relevant age group)"

## [584] "Lower secondary completion rate, male (% of relevant age group)"

## [585] "Lower secondary completion rate, total (% of relevant age group)"

## [586] "Lower secondary school starting age (years)"

## [587] "Mammal species, threatened"

## [588] "Manufactures exports (% of merchandise exports)"

## [589] "Manufactures imports (% of merchandise imports)"

## [590] "Manufacturing, value added (% of GDP)"

## [591] "Manufacturing, value added (annual % growth)"

## [592] "Manufacturing, value added (constant 2010 US$)"

## [593] "Manufacturing, value added (constant LCU)"

## [594] "Manufacturing, value added (current LCU)"

## [595] "Manufacturing, value added (current US$)"

## [596] "Maternal mortality ratio (modeled estimate, per 100,000 live births)"

## [597] "Maternal mortality ratio (national estimate, per 100,000 live births)"

## [598] "Medium and high-tech exports (% manufactured exports)"

## [599] "Medium and high-tech Industry (including construction) (% manufacturing value added)"

## [600] "Merchandise exports (current US$)"

## [601] "Merchandise exports by the reporting economy (current US$)"

## [602] "Merchandise exports by the reporting economy, residual (% of total merchandise exports)"

## [603] "Merchandise exports to economies in the Arab World (% of total merchandise exports)"

## [604] "Merchandise exports to high-income economies (% of total merchandise exports)"

## [605] "Merchandise exports to low- and middle-income economies in East Asia & Pacific (% of total merchandise exports)"

## [606] "Merchandise exports to low- and middle-income economies in Europe & Central Asia (% of total merchandise exports)"

## [607] "Merchandise exports to low- and middle-income economies in Latin America & the Caribbean (% of total merchandise exports)"

## [608] "Merchandise exports to low- and middle-income economies in Middle East & North Africa (% of total merchandise exports)"

## [609] "Merchandise exports to low- and middle-income economies in South Asia (% of total merchandise exports)"

## [610] "Merchandise exports to low- and middle-income economies in Sub-Saharan Africa (% of total merchandise exports)"

## [611] "Merchandise exports to low- and middle-income economies outside region (% of total merchandise exports)"

## [612] "Merchandise exports to low- and middle-income economies within region (% of total merchandise exports)"

## [613] "Merchandise imports (current US$)"

## [614] "Merchandise imports by the reporting economy (current US$)"

## [615] "Merchandise imports by the reporting economy, residual (% of total merchandise imports)"

## [616] "Merchandise imports from economies in the Arab World (% of total merchandise imports)"

## [617] "Merchandise imports from high-income economies (% of total merchandise imports)"

## [618] "Merchandise imports from low- and middle-income economies in East Asia & Pacific (% of total merchandise imports)"

## [619] "Merchandise imports from low- and middle-income economies in Europe & Central Asia (% of total merchandise imports)"

## [620] "Merchandise imports from low- and middle-income economies in Latin America & the Caribbean (% of total merchandise imports)"

## [621] "Merchandise imports from low- and middle-income economies in Middle East & North Africa (% of total merchandise imports)"

## [622] "Merchandise imports from low- and middle-income economies in South Asia (% of total merchandise imports)"

## [623] "Merchandise imports from low- and middle-income economies in Sub-Saharan Africa (% of total merchandise imports)"

## [624] "Merchandise imports from low- and middle-income economies outside region (% of total merchandise imports)"

## [625] "Merchandise imports from low- and middle-income economies within region (% of total merchandise imports)"

## [626] "Merchandise trade (% of GDP)"

## [627] "Methane emissions (% change from 1990)"

## [628] "Methane emissions (kt of CO2 equivalent)"

## [629] "Methane emissions in energy sector (thousand metric tons of CO2 equivalent)"

## [630] "Methodology assessment of statistical capacity (scale 0 - 100)"

## [631] "Military expenditure (% of GDP)"

## [632] "Military expenditure (% of general government expenditure)"

## [633] "Military expenditure (current LCU)"

## [634] "Military expenditure (current USD)"

## [635] "Mineral rents (% of GDP)"

## [636] "Mobile cellular subscriptions"

## [637] "Mobile cellular subscriptions (per 100 people)"

## [638] "Monetary Sector credit to private sector (% GDP)"

## [639] "Mortality caused by road traffic injury (per 100,000 people)"

## [640] "Mortality from CVD, cancer, diabetes or CRD between exact ages 30 and 70 (%)"

## [641] "Mortality from CVD, cancer, diabetes or CRD between exact ages 30 and 70, female (%)"

## [642] "Mortality from CVD, cancer, diabetes or CRD between exact ages 30 and 70, male (%)"

## [643] "Mortality rate attributed to household and ambient air pollution, age-standardized (per 100,000 population)"

## [644] "Mortality rate attributed to household and ambient air pollution, age-standardized, female (per 100,000 female population)"

## [645] "Mortality rate attributed to household and ambient air pollution, age-standardized, male (per 100,000 male population)"

## [646] "Mortality rate attributed to unintentional poisoning (per 100,000 population)"

## [647] "Mortality rate attributed to unintentional poisoning, female (per 100,000 female population)"

## [648] "Mortality rate attributed to unintentional poisoning, male (per 100,000 male population)"

## [649] "Mortality rate attributed to unsafe water, unsafe sanitation and lack of hygiene (per 100,000 population)"

## [650] "Mortality rate, adult, female (per 1,000 female adults)"

## [651] "Mortality rate, adult, male (per 1,000 male adults)"

## [652] "Mortality rate, infant (per 1,000 live births)"

## [653] "Mortality rate, infant, female (per 1,000 live births)"

## [654] "Mortality rate, infant, male (per 1,000 live births)"

## [655] "Mortality rate, neonatal (per 1,000 live births)"

## [656] "Mortality rate, under-5 (per 1,000 live births)"

## [657] "Mortality rate, under-5, female (per 1,000 live births)"

## [658] "Mortality rate, under-5, male (per 1,000 live births)"

## [659] "Multidimensional poverty headcount ratio (% of total population)"

## [660] "Multidimensional poverty headcount ratio, children (% of population ages 0-17)"

## [661] "Multidimensional poverty index (scale 0-1)"

## [662] "Multidimensional poverty index, children (population ages 0-17) (scale 0-1)"

## [663] "Multidimensional poverty intensity (average share of deprivations experienced by the poor)"

## [664] "Multilateral debt service (% of public and publicly guaranteed debt service)"

## [665] "Multilateral debt service (TDS, current US$)"

## [666] "Natural gas rents (% of GDP)"

## [667] "Net acquisition of financial assets (% of GDP)"

## [668] "Net acquisition of financial assets (current LCU)"

## [669] "Net barter terms of trade index (2000 = 100)"

## [670] "Net bilateral aid flows from DAC donors, Australia (current US$)"

## [671] "Net bilateral aid flows from DAC donors, Austria (current US$)"

## [672] "Net bilateral aid flows from DAC donors, Belgium (current US$)"

## [673] "Net bilateral aid flows from DAC donors, Canada (current US$)"

## [674] "Net bilateral aid flows from DAC donors, Czech Republic (current US$)"

## [675] "Net bilateral aid flows from DAC donors, Denmark (current US$)"

## [676] "Net bilateral aid flows from DAC donors, European Union institutions (current US$)"

## [677] "Net bilateral aid flows from DAC donors, Finland (current US$)"

## [678] "Net bilateral aid flows from DAC donors, France (current US$)"

## [679] "Net bilateral aid flows from DAC donors, Germany (current US$)"

## [680] "Net bilateral aid flows from DAC donors, Greece (current US$)"

## [681] "Net bilateral aid flows from DAC donors, Hungary (current US$)"

## [682] "Net bilateral aid flows from DAC donors, Iceland (current US$)"

## [683] "Net bilateral aid flows from DAC donors, Ireland (current US$)"

## [684] "Net bilateral aid flows from DAC donors, Italy (current US$)"

## [685] "Net bilateral aid flows from DAC donors, Japan (current US$)"

## [686] "Net bilateral aid flows from DAC donors, Korea, Rep. (current US$)"

## [687] "Net bilateral aid flows from DAC donors, Luxembourg (current US$)"

## [688] "Net bilateral aid flows from DAC donors, Netherlands (current US$)"

## [689] "Net bilateral aid flows from DAC donors, New Zealand (current US$)"

## [690] "Net bilateral aid flows from DAC donors, Norway (current US$)"

## [691] "Net bilateral aid flows from DAC donors, Poland (current US$)"

## [692] "Net bilateral aid flows from DAC donors, Portugal (current US$)"

## [693] "Net bilateral aid flows from DAC donors, Slovak Republic (current US$)"

## [694] "Net bilateral aid flows from DAC donors, Slovenia (current US$)"

## [695] "Net bilateral aid flows from DAC donors, Spain (current US$)"

## [696] "Net bilateral aid flows from DAC donors, Sweden (current US$)"

## [697] "Net bilateral aid flows from DAC donors, Switzerland (current US$)"

## [698] "Net bilateral aid flows from DAC donors, Total (current US$)"

## [699] "Net bilateral aid flows from DAC donors, United Kingdom (current US$)"

## [700] "Net bilateral aid flows from DAC donors, United States (current US$)"

## [701] "Net capital account (BoP, current US$)"

## [702] "Net domestic credit (current LCU)"

## [703] "Net errors and omissions (BoP, current US$)"

## [704] "Net financial account (BoP, current US$)"

## [705] "Net financial flows, bilateral (NFL, current US$)"

## [706] "Net financial flows, IBRD (NFL, current US$)"

## [707] "Net financial flows, IDA (NFL, current US$)"

## [708] "Net financial flows, IMF concessional (NFL, current US$)"

## [709] "Net financial flows, IMF nonconcessional (NFL, current US$)"

## [710] "Net financial flows, multilateral (NFL, current US$)"

## [711] "Net financial flows, others (NFL, current US$)"

## [712] "Net financial flows, RDB concessional (NFL, current US$)"

## [713] "Net financial flows, RDB nonconcessional (NFL, current US$)"

## [714] "Net flows on external debt, private nonguaranteed (PNG) (NFL, current US$)"

## [715] "Net foreign assets (current LCU)"

## [716] "Net incurrence of liabilities, total (% of GDP)"

## [717] "Net incurrence of liabilities, total (current LCU)"

## [718] "Net intake rate in grade 1 (% of official school-age population)"

## [719] "Net intake rate in grade 1, female (% of official school-age population)"

## [720] "Net intake rate in grade 1, male (% of official school-age population)"

## [721] "Net investment in nonfinancial assets (% of GDP)"

## [722] "Net investment in nonfinancial assets (current LCU)"

## [723] "Net lending (+) / net borrowing (-) (% of GDP)"

## [724] "Net lending (+) / net borrowing (-) (current LCU)"

## [725] "Net migration"

## [726] "Net ODA received (% of central government expense)"

## [727] "Net ODA received (% of GNI)"

## [728] "Net ODA received (% of gross capital formation)"

## [729] "Net ODA received (% of imports of goods, services and primary income)"

## [730] "Net ODA received per capita (current US$)"

## [731] "Net official development assistance and official aid received (constant 2015 US$)"

## [732] "Net official development assistance and official aid received (current US$)"

## [733] "Net official development assistance received (constant 2015 US$)"

## [734] "Net official development assistance received (current US$)"

## [735] "Net official flows from UN agencies, FAO (current US$)"

## [736] "Net official flows from UN agencies, IAEA (current US$)"

## [737] "Net official flows from UN agencies, IFAD (current US$)"

## [738] "Net official flows from UN agencies, ILO (current US$)"

## [739] "Net official flows from UN agencies, UNDP (current US$)"

## [740] "Net official flows from UN agencies, UNFPA (current US$)"

## [741] "Net official flows from UN agencies, UNHCR (current US$)"

## [742] "Net official flows from UN agencies, UNICEF (current US$)"

## [743] "Net official flows from UN agencies, UNTA (current US$)"

## [744] "Net official flows from UN agencies, WFP (current US$)"

## [745] "Net official flows from UN agencies, WHO (current US$)"

## [746] "Net primary income (BoP, current US$)"

## [747] "Net primary income (Net income from abroad) (current LCU)"

## [748] "Net primary income (Net income from abroad) (current US$)"

## [749] "Net secondary income (BoP, current US$)"

## [750] "Net secondary income (Net current transfers from abroad) (current LCU)"

## [751] "Net secondary income (Net current transfers from abroad) (current US$)"

## [752] "Net trade in goods (BoP, current US$)"

## [753] "Net trade in goods and services (BoP, current US$)"

## [754] "New business density (new registrations per 1,000 people ages 15-64)"

## [755] "New businesses registered (number)"

## [756] "Newborns protected against tetanus (%)"

## [757] "Nitrous oxide emissions (% change from 1990)"

## [758] "Nitrous oxide emissions (thousand metric tons of CO2 equivalent)"

## [759] "Nitrous oxide emissions in energy sector (% of total)"

## [760] "Nitrous oxide emissions in energy sector (thousand metric tons of CO2 equivalent)"

## [761] "Number of deaths ages 5-14 years"

## [762] "Number of infant deaths"

## [763] "Number of maternal deaths"

## [764] "Number of neonatal deaths"

## [765] "Number of under-five deaths"

## [766] "Nurses and midwives (per 1,000 people)"

## [767] "Official exchange rate (LCU per US$, period average)"

## [768] "Oil rents (% of GDP)"

## [769] "Ores and metals exports (% of merchandise exports)"

## [770] "Ores and metals imports (% of merchandise imports)"

## [771] "Other expense (% of expense)"

## [772] "Other expense (current LCU)"

## [773] "Other greenhouse gas emissions (% change from 1990)"

## [774] "Other greenhouse gas emissions, HFC, PFC and SF6 (thousand metric tons of CO2 equivalent)"

## [775] "Other taxes (% of revenue)"

## [776] "Other taxes (current LCU)"

## [777] "Other taxes payable by businesses (% of commercial profits)"

## [778] "Out-of-pocket expenditure (% of current health expenditure)"

## [779] "Out-of-pocket expenditure per capita (current US$)"

## [780] "Out-of-pocket expenditure per capita, PPP (current international $)"

## [781] "Over-age students, primary (% of enrollment)"

## [782] "Over-age students, primary, female (% of female enrollment)"

## [783] "Over-age students, primary, male (% of male enrollment)"

## [784] "Part time employment, female (% of total female employment)"

## [785] "Part time employment, male (% of total male employment)"

## [786] "Part time employment, total (% of total employment)"

## [787] "People practicing open defecation (% of population)"

## [788] "People practicing open defecation, rural (% of rural population)"

## [789] "People practicing open defecation, urban (% of urban population)"

## [790] "People using at least basic drinking water services (% of population)"

## [791] "People using at least basic drinking water services, rural (% of rural population)"

## [792] "People using at least basic drinking water services, urban (% of urban population)"

## [793] "People using at least basic sanitation services (% of population)"

## [794] "People using at least basic sanitation services, rural (% of rural population)"

## [795] "People using at least basic sanitation services, urban (% of urban population)"

## [796] "People with basic handwashing facilities including soap and water (% of population)"

## [797] "People with basic handwashing facilities including soap and water, rural (% of rural population)"

## [798] "People with basic handwashing facilities including soap and water, urban (% of urban population)"

## [799] "Periodicity and timeliness assessment of statistical capacity (scale 0 - 100)"

## [800] "Permanent cropland (% of land area)"

## [801] "Persistence to grade 5, female (% of cohort)"

## [802] "Persistence to grade 5, male (% of cohort)"

## [803] "Persistence to grade 5, total (% of cohort)"

## [804] "Persistence to last grade of primary, female (% of cohort)"

## [805] "Persistence to last grade of primary, male (% of cohort)"

## [806] "Persistence to last grade of primary, total (% of cohort)"

## [807] "Personal remittances, paid (current US$)"

## [808] "Personal remittances, received (% of GDP)"

## [809] "Personal remittances, received (current US$)"

## [810] "Personal transfers, receipts (BoP, current US$)"

## [811] "Physicians (per 1,000 people)"

## [812] "Plant species (higher), threatened"

## [813] "PM2.5 air pollution, mean annual exposure (micrograms per cubic meter)"

## [814] "PM2.5 air pollution, population exposed to levels exceeding WHO guideline value (% of total)"

## [815] "PM2.5 pollution, population exposed to levels exceeding WHO Interim Target-1 value (% of total)"

## [816] "PM2.5 pollution, population exposed to levels exceeding WHO Interim Target-2 value (% of total)"

## [817] "PM2.5 pollution, population exposed to levels exceeding WHO Interim Target-3 value (% of total)"

## [818] "PNG, bonds (NFL, current US$)"

## [819] "PNG, commercial banks and other creditors (NFL, current US$)"

## [820] "Population ages 0-14 (% of total population)"

## [821] "Population ages 0-14, female"

## [822] "Population ages 0-14, female (% of female population)"

## [823] "Population ages 0-14, male"

## [824] "Population ages 0-14, male (% of male population)"

## [825] "Population ages 0-14, total"

## [826] "Population ages 00-04, female (% of female population)"

## [827] "Population ages 00-04, male (% of male population)"

## [828] "Population ages 05-09, female (% of female population)"

## [829] "Population ages 05-09, male (% of male population)"

## [830] "Population ages 10-14, female (% of female population)"

## [831] "Population ages 10-14, male (% of male population)"

## [832] "Population ages 15-19, female (% of female population)"

## [833] "Population ages 15-19, male (% of male population)"

## [834] "Population ages 15-64 (% of total population)"

## [835] "Population ages 15-64, female"

## [836] "Population ages 15-64, female (% of female population)"

## [837] "Population ages 15-64, male"

## [838] "Population ages 15-64, male (% of male population)"

## [839] "Population ages 15-64, total"

## [840] "Population ages 20-24, female (% of female population)"

## [841] "Population ages 20-24, male (% of male population)"

## [842] "Population ages 25-29, female (% of female population)"

## [843] "Population ages 25-29, male (% of male population)"

## [844] "Population ages 30-34, female (% of female population)"

## [845] "Population ages 30-34, male (% of male population)"

## [846] "Population ages 35-39, female (% of female population)"

## [847] "Population ages 35-39, male (% of male population)"

## [848] "Population ages 40-44, female (% of female population)"

## [849] "Population ages 40-44, male (% of male population)"

## [850] "Population ages 45-49, female (% of female population)"

## [851] "Population ages 45-49, male (% of male population)"

## [852] "Population ages 50-54, female (% of female population)"

## [853] "Population ages 50-54, male (% of male population)"

## [854] "Population ages 55-59, female (% of female population)"

## [855] "Population ages 55-59, male (% of male population)"

## [856] "Population ages 60-64, female (% of female population)"

## [857] "Population ages 60-64, male (% of male population)"

## [858] "Population ages 65 and above (% of total population)"

## [859] "Population ages 65 and above, female"

## [860] "Population ages 65 and above, female (% of female population)"

## [861] "Population ages 65 and above, male"

## [862] "Population ages 65 and above, male (% of male population)"

## [863] "Population ages 65 and above, total"

## [864] "Population ages 65-69, female (% of female population)"

## [865] "Population ages 65-69, male (% of male population)"

## [866] "Population ages 70-74, female (% of female population)"

## [867] "Population ages 70-74, male (% of male population)"

## [868] "Population ages 75-79, female (% of female population)"

## [869] "Population ages 75-79, male (% of male population)"

## [870] "Population ages 80 and above, female (% of female population)"

## [871] "Population ages 80 and above, male (% of male population)"

## [872] "Population density (people per sq. km of land area)"

## [873] "Population growth (annual %)"

## [874] "Population in largest city"

## [875] "Population in the largest city (% of urban population)"

## [876] "Population in urban agglomerations of more than 1 million"

## [877] "Population in urban agglomerations of more than 1 million (% of total population)"

## [878] "Population living in slums (% of urban population)"

## [879] "Population, female"

## [880] "Population, female (% of total population)"

## [881] "Population, male"

## [882] "Population, male (% of total population)"

## [883] "Population, total"

## [884] "Portfolio equity, net inflows (BoP, current US$)"

## [885] "Portfolio investment, bonds (PPG + PNG) (NFL, current US$)"

## [886] "Portfolio investment, net (BoP, current US$)"

## [887] "Poverty headcount ratio at national poverty lines (% of population)"

## [888] "Power outages in firms in a typical month (number)"

## [889] "PPG, bonds (NFL, current US$)"

## [890] "PPG, commercial banks (NFL, current US$)"

## [891] "PPG, IBRD (DOD, current US$)"

## [892] "PPG, IDA (DOD, current US$)"

## [893] "PPG, official creditors (NFL, current US$)"

## [894] "PPG, other private creditors (NFL, current US$)"

## [895] "PPG, private creditors (NFL, current US$)"

## [896] "PPP conversion factor, GDP (LCU per international $)"

## [897] "PPP conversion factor, private consumption (LCU per international $)"

## [898] "Pregnant women receiving prenatal care (%)"

## [899] "Preprimary education, duration (years)"

## [900] "Presence of peace keepers (number of troops, police, and military observers in mandate)"

## [901] "Present value of external debt (% of exports of goods, services and primary income)"

## [902] "Present value of external debt (% of GNI)"

## [903] "Present value of external debt (current US$)"

## [904] "Prevalence of anemia among children (% of children under 5)"

## [905] "Prevalence of anemia among non-pregnant women (% of women ages 15-49)"

## [906] "Prevalence of anemia among pregnant women (%)"

## [907] "Prevalence of anemia among women of reproductive age (% of women ages 15-49)"

## [908] "Prevalence of HIV, female (% ages 15-24)"

## [909] "Prevalence of HIV, male (% ages 15-24)"

## [910] "Prevalence of HIV, total (% of population ages 15-49)"

## [911] "Prevalence of moderate or severe food insecurity in the population (%)"

## [912] "Prevalence of overweight, weight for height (% of children under 5)"

## [913] "Prevalence of overweight, weight for height, female (% of children under 5)"

## [914] "Prevalence of overweight, weight for height, male (% of children under 5)"

## [915] "Prevalence of severe food insecurity in the population (%)"

## [916] "Prevalence of severe wasting, weight for height (% of children under 5)"

## [917] "Prevalence of severe wasting, weight for height, female (% of children under 5)"

## [918] "Prevalence of severe wasting, weight for height, male (% of children under 5)"

## [919] "Prevalence of stunting, height for age (% of children under 5)"

## [920] "Prevalence of stunting, height for age, female (% of children under 5)"

## [921] "Prevalence of stunting, height for age, male (% of children under 5)"

## [922] "Prevalence of undernourishment (% of population)"

## [923] "Prevalence of underweight, weight for age (% of children under 5)"

## [924] "Prevalence of underweight, weight for age, female (% of children under 5)"

## [925] "Prevalence of underweight, weight for age, male (% of children under 5)"

## [926] "Prevalence of wasting, weight for height (% of children under 5)"

## [927] "Prevalence of wasting, weight for height, female (% of children under 5)"

## [928] "Prevalence of wasting, weight for height, male (% of children under 5)"

## [929] "Price level ratio of PPP conversion factor (GDP) to market exchange rate"

## [930] "Primary completion rate, female (% of relevant age group)"

## [931] "Primary completion rate, male (% of relevant age group)"

## [932] "Primary completion rate, total (% of relevant age group)"

## [933] "Primary education, duration (years)"

## [934] "Primary education, pupils"

## [935] "Primary education, pupils (% female)"

## [936] "Primary education, teachers"

## [937] "Primary education, teachers (% female)"

## [938] "Primary government expenditures as a proportion of original approved budget (%)"

## [939] "Primary income payments (BoP, current US$)"

## [940] "Primary income receipts (BoP, current US$)"

## [941] "Primary school starting age (years)"

## [942] "Private credit bureau coverage (% of adults)"

## [943] "Probability of dying at age 5-14 years (per 1,000 children age 5)"

## [944] "Procedures to build a warehouse (number)"

## [945] "Procedures to register property (number)"

## [946] "Profit tax (% of commercial profits)"

## [947] "Progression to secondary school (%)"

## [948] "Progression to secondary school, female (%)"

## [949] "Progression to secondary school, male (%)"

## [950] "Proportion of population pushed below the $1.90 ($ 2011 PPP) poverty line by out-of-pocket health care expenditure (%)"

## [951] "Proportion of population spending more than 10% of household consumption or income on out-of-pocket health care expenditure (%)"

## [952] "Proportion of population spending more than 25% of household consumption or income on out-of-pocket health care expenditure (%)"

## [953] "Proportion of seats held by women in national parliaments (%)"

## [954] "Proportion of women subjected to physical and/or sexual violence in the last 12 months (% of women age 15-49)"

## [955] "Public and publicly guaranteed debt service (% of exports of goods, services and primary income)"

## [956] "Public and publicly guaranteed debt service (% of GNI)"

## [957] "Public credit registry coverage (% of adults)"

## [958] "Public private partnerships investment in energy (current US$)"

## [959] "Pump price for diesel fuel (US$ per liter)"

## [960] "Pump price for gasoline (US$ per liter)"

## [961] "Pupil-teacher ratio, lower secondary"

## [962] "Pupil-teacher ratio, preprimary"

## [963] "Pupil-teacher ratio, primary"

## [964] "Pupil-teacher ratio, secondary"

## [965] "Pupil-teacher ratio, tertiary"

## [966] "Pupil-teacher ratio, upper secondary"

## [967] "Ratio of female to male labor force participation rate (%) (modeled ILO estimate)"

## [968] "Ratio of female to male labor force participation rate (%) (national estimate)"

## [969] "Real interest rate (%)"

## [970] "Refugee population by country or territory of asylum"

## [971] "Refugee population by country or territory of origin"

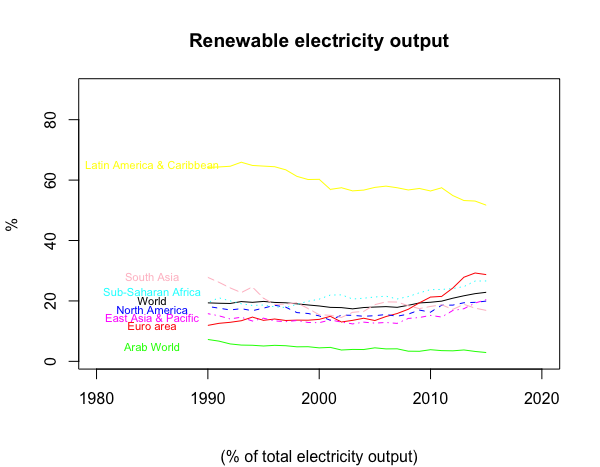

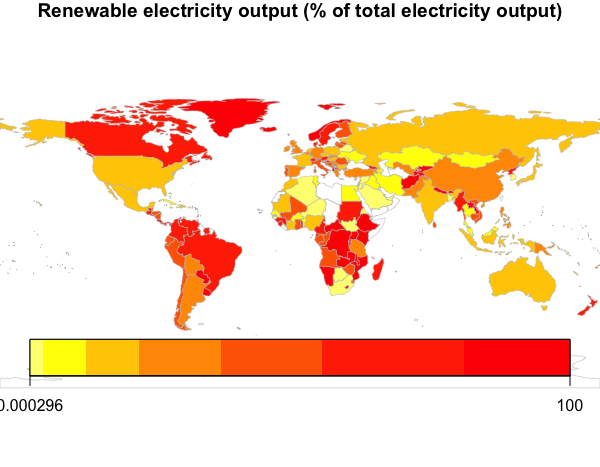

## [972] "Renewable electricity output (% of total electricity output)"

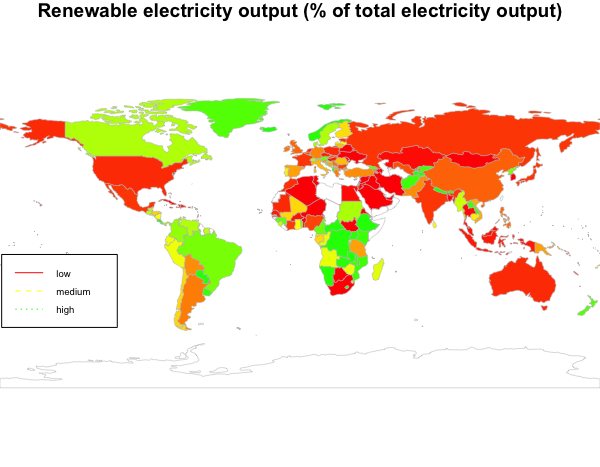

## [973] "Renewable energy consumption (% of total final energy consumption)"

## [974] "Renewable internal freshwater resources per capita (cubic meters)"

## [975] "Renewable internal freshwater resources, total (billion cubic meters)"

## [976] "Repeaters, primary, female (% of female enrollment)"

## [977] "Repeaters, primary, male (% of male enrollment)"

## [978] "Repeaters, primary, total (% of total enrollment)"

## [979] "Reserves and related items (BoP, current US$)"

## [980] "Revenue, excluding grants (% of GDP)"

## [981] "Revenue, excluding grants (current LCU)"

## [982] "Rural population"

## [983] "Rural population (% of total population)"

## [984] "Rural population growth (annual %)"

## [985] "School enrollment, preprimary (% gross)"

## [986] "School enrollment, preprimary, female (% gross)"

## [987] "School enrollment, preprimary, male (% gross)"

## [988] "School enrollment, primary (% gross)"

## [989] "School enrollment, primary (% net)"

## [990] "School enrollment, primary (gross), gender parity index (GPI)"

## [991] "School enrollment, primary and secondary (gross), gender parity index (GPI)"

## [992] "School enrollment, primary, female (% gross)"

## [993] "School enrollment, primary, female (% net)"

## [994] "School enrollment, primary, male (% gross)"

## [995] "School enrollment, primary, male (% net)"

## [996] "School enrollment, primary, private (% of total primary)"

## [997] "School enrollment, secondary (% gross)"

## [998] "School enrollment, secondary (% net)"

## [999] "School enrollment, secondary (gross), gender parity index (GPI)"

## [1000] "School enrollment, secondary, female (% gross)"

## [1001] "School enrollment, secondary, female (% net)"

## [1002] "School enrollment, secondary, male (% gross)"

## [1003] "School enrollment, secondary, male (% net)"

## [1004] "School enrollment, secondary, private (% of total secondary)"

## [1005] "School enrollment, tertiary (% gross)"

## [1006] "School enrollment, tertiary (gross), gender parity index (GPI)"

## [1007] "School enrollment, tertiary, female (% gross)"

## [1008] "School enrollment, tertiary, male (% gross)"

## [1009] "Scientific and technical journal articles"

## [1010] "Secondary education, duration (years)"

## [1011] "Secondary education, general pupils"

## [1012] "Secondary education, general pupils (% female)"

## [1013] "Secondary education, pupils"

## [1014] "Secondary education, pupils (% female)"

## [1015] "Secondary education, teachers"

## [1016] "Secondary education, teachers (% female)"

## [1017] "Secondary education, teachers, female"

## [1018] "Secondary education, vocational pupils"

## [1019] "Secondary education, vocational pupils (% female)"

## [1020] "Secondary income receipts (BoP, current US$)"

## [1021] "Secondary income, other sectors, payments (BoP, current US$)"

## [1022] "Secure Internet servers"

## [1023] "Secure Internet servers (per 1 million people)"

## [1024] "Self-employed, female (% of female employment) (modeled ILO estimate)"

## [1025] "Self-employed, male (% of male employment) (modeled ILO estimate)"

## [1026] "Self-employed, total (% of total employment) (modeled ILO estimate)"

## [1027] "Service exports (BoP, current US$)"

## [1028] "Service imports (BoP, current US$)"

## [1029] "Services, value added (% of GDP)"

## [1030] "Services, value added (annual % growth)"

## [1031] "Services, value added (constant 2010 US$)"

## [1032] "Services, value added (constant LCU)"

## [1033] "Services, value added (current LCU)"

## [1034] "Services, value added (current US$)"

## [1035] "Services, value added per worker (constant 2010 US$)"

## [1036] "Sex ratio at birth (male births per female births)"

## [1037] "Share of tariff lines with international peaks, all products (%)"

## [1038] "Share of tariff lines with international peaks, manufactured products (%)"

## [1039] "Share of tariff lines with international peaks, primary products (%)"

## [1040] "Share of tariff lines with specific rates, all products (%)"

## [1041] "Share of tariff lines with specific rates, manufactured products (%)"

## [1042] "Share of tariff lines with specific rates, primary products (%)"

## [1043] "Share of youth not in education, employment or training, female (% of female youth population)"

## [1044] "Share of youth not in education, employment or training, male (% of male youth population)"

## [1045] "Share of youth not in education, employment or training, total (% of youth population)"

## [1046] "Short-term debt (% of exports of goods, services and primary income)"

## [1047] "Short-term debt (% of total external debt)"

## [1048] "Short-term debt (% of total reserves)"

## [1049] "Social contributions (% of revenue)"

## [1050] "Social contributions (current LCU)"

## [1051] "Source data assessment of statistical capacity (scale 0 - 100)"

## [1052] "Specialist surgical workforce (per 100,000 population)"

## [1053] "Start-up procedures to register a business (number)"

## [1054] "Start-up procedures to register a business, female (number)"

## [1055] "Start-up procedures to register a business, male (number)"

## [1056] "Statistical Capacity score (Overall average)"

## [1057] "Strength of legal rights index (0=weak to 12=strong)"

## [1058] "Subsidies and other transfers (% of expense)"

## [1059] "Subsidies and other transfers (current LCU)"

## [1060] "Suicide mortality rate (per 100,000 population)"

## [1061] "Suicide mortality rate, female (per 100,000 female population)"

## [1062] "Suicide mortality rate, male (per 100,000 male population)"